Updated on: 03-01-2025

Published by: John C. Derrick

Hawaii Tourism Statistics

This article may include unbiased affiliate links at no extra cost to you. Mahalo for your support!

Hawaii Visitor & Traveler Data

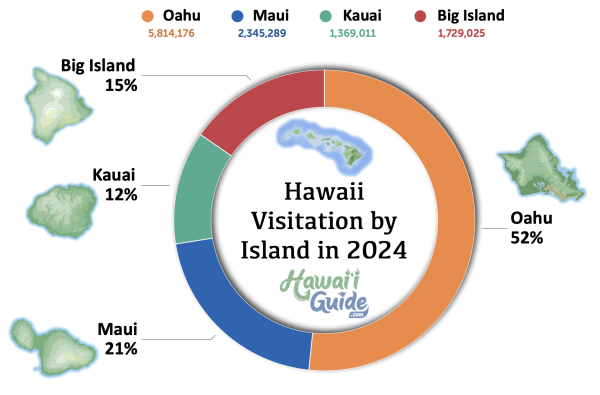

Hawaii Visitors by Island 2024

If it's Hawaii tourism data you're looking for, then you're in the right place. We'll cover the latest tourism trends (within the last 1-3 years) on the Hawaiian islands and provide a series of graphics and summarized data to give you a good idea of what's happening by the numbers.

The adjacent graph shows the Total ARRIVAL Data in 2024 to each island (including multi-destination/island arrivals). You can also view our historical 2023 data graph, 2022 data graph, 2018 data graph, 2016 data graph, and 2006 data graph for comparison.

A pie chart is not truly the best format to display the visitor totals for the various islands as the number of visitors shown in the chart is greater than the true total, as many visitors go to more than one island. However, for our purposes, it should give you an idea of how many visitors (percentage-wise) are arriving/visiting each island. Just keep in mind the actual arrival numbers are "inflated" a bit. A more accurate way to look at this is 'Visitor Days,' per island, but these percentages seen here provide an accurate overview of each island's visitation.

Total Visitor Arrivals by Island

2025 - 2026 Hawaii Travel Projections

General Expectations for 2025-2026

The travel outlook for Hawaii in 2025 and 2026 presents a cautiously optimistic picture, with varying recovery trajectories across the islands, particularly for Maui following the 2023 wildfires. Here’s an updated overview:

Visitor Numbers and Spending:

- Statewide Trends: Hawaii’s tourism sector is projected to experience modest growth, with visitor arrivals expected to expand by nearly 3% in 2025. However, a full return to pre-pandemic levels may not occur until 2027.

- Economic Contributions: The tourism industry remains a vital component of Hawaii’s economy, with visitor spending anticipated to increase from $21.1 billion in 2023 to $23.6 billion by 2026.

Maui’s Recovery:

- Post-Wildfire Rebound: Maui continues its recovery from the August 2023 wildfires with efforts to rebuild and revitalize the tourism sector. While West Maui has reopened to visitors, the pace of recovery is gradual, and the area still faces challenges in restoring its tourism industry.

- Economic Impact: The wildfires significantly affected Maui’s tourism, with visitor arrivals and spending experiencing notable declines. Recovery efforts are ongoing, focusing on rebuilding infrastructure and restoring visitor confidence.

Island-Specific Outlooks:

- Oahu: Anticipated to experience steady growth in visitor numbers, with a gradual return of international travelers, including those from Japan, contributing to the island’s tourism recovery.

- Kauai and Hawaii Island: Both islands are expected to see continued growth in visitor arrivals and spending, with their unique attractions drawing steady interest from travelers.

Sustainable Tourism Initiatives:

- Focus on Sustainability: Hawaii increasingly emphasizes sustainable tourism practices, encouraging visitors to engage in eco-friendly activities and supporting local communities. This shift aims to preserve the islands’ natural beauty and cultural heritage for future generations.

As Hawaii navigates the complexities of tourism recovery, travelers planning visits in 2025 and 2026 can look forward to a destination that is not only rebuilding but also striving to offer more sustainable and culturally enriching experiences.

Hawaiian Islands Demand

Estimated Hawaii Visitors by Month

The tabular chart shown below gives the breakdown of visitors in the islands on a month by month basis (color coded per island), based on data from recent visitor reports.

Visitor Days & Visitor Expenditures

In considering the "health" of the tourism market, one must also put emphasis on the two factors that are the most important: "visitor days" and "visitor expenditures."

Mahalo for the tip by 'amberloo' at TripAdvisor. In her words, "If there are more visitor days and more money being spent annually over the long-term, the industry is healthy regardless of any other factors; such as mere arrival totals. The goal of many government planners is to increase "days" and "spending" while limiting (or even decreasing) arrival counts."

Why limit arrival counts you might ask? One has to consider tourism "capacities" of the islands and how that will affect future trends. Maui and O'ahu likely reached their carrying capacity (for visitors) years ago, thus have few remaining competitive development opportunities and will not have the statistical fluctuations or upside growth potentials seen on Kaua'i. In fact, due to growth in recent years, Kaua'i has now about reached its own carrying capacity pending completion of on-going development.

Hawaii Visitor Graphs

Latest DBEDT Tourism Updates

Department of Business, Economic Development and Tourism - Monthly Summary

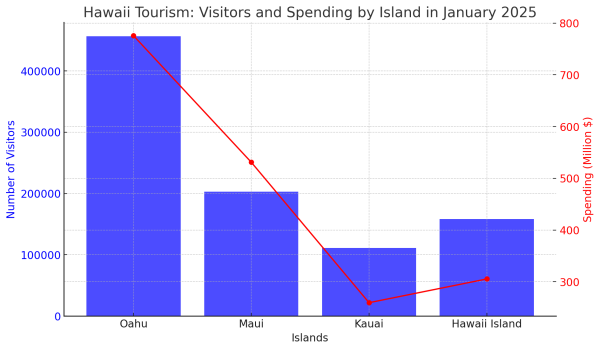

January 2025 Visitation & Spending

January 2025 Summary Update

In January 2025, Hawaii saw a 3.8% increase in visitor arrivals (792,177 visitors) and a 4.7% increase in spending ($1.89 billion) compared to January 2024. Most visitors arrived by air, with a slight increase in cruise ship arrivals.

Island-Specific Numbers:

- Oahu: 456,607 visitors, $775.8 million spent.

- Maui: 202,738 visitors, $531.1 million spent.

- Kauai: 111,293 visitors, $259.5 million spent.

- Hawaii Island: 158,141 visitors, $305.4 million spent.

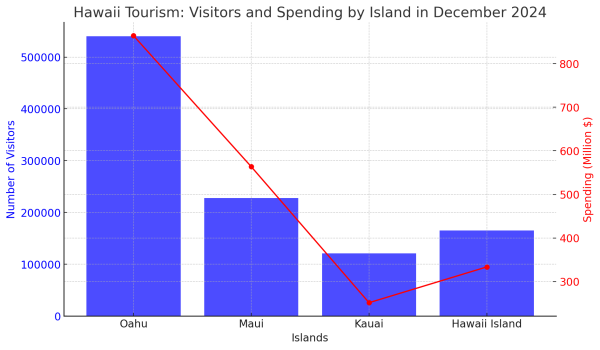

December 2024 Visitation & Spending

December 2024 Summary Update

In December 2024, Hawaii saw a 5.5% increase in visitor arrivals (910,055 visitors) and a 4.7% increase in spending ($2.04 billion) compared to December 2023. Most visitors arrived by air, with increased arrivals from the U.S. West and East.

Island-Specific Numbers:

- Oahu: 540,147 visitors, $864.3 million spent.

- Maui: 227,800 visitors, $563.6 million spent.

- Kauai: 120,916 visitors, $251.5 million spent.

- Hawaii Island: 165,512 visitors, $333.6 million spent.

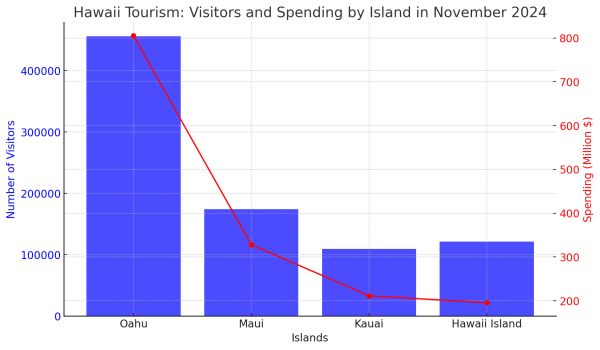

November 2024 Visitation & Spending

November 2024 Summary Update

In November 2024, Hawaii welcomed 770,940 visitors, marking a 5.3% increase from November 2023. Spending rose by 2.0% to $1.55 billion. The majority of arrivals were by air (762,662 visitors), primarily from the U.S. West and East. The average length of stay decreased slightly to 8.43 days compared to November 2023.

Island-Specific Numbers:

- Oahu: 455,982 visitors, $805.5 million spent.

- Maui: 174,005 visitors, $328.2 million spent.

- Kauai: 109,673 visitors, $211.3 million spent.

- Hawaii Island: 121,280 visitors, $195.6 million spent.

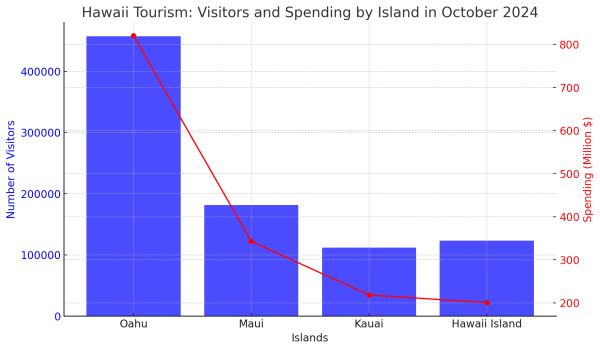

October 2024 Visitation & Spending

October 2024 Summary Update

In October 2024, Hawaii experienced a 5.4% increase in visitor arrivals (774,617 visitors) and a 6.2% rise in spending ($1.58 billion) compared to October 2023. Most visitors arrived by air, with increased arrivals from the U.S. West and East. Cruise ship arrivals also showed modest growth.

Island-Specific Numbers:

- Oahu: 457,389 visitors, $820.2 million spent.

- Maui: 181,732 visitors, $342.8 million spent.

- Kauai: 112,091 visitors, $218.5 million spent.

- Hawaii Island: 123,405 visitors, $200.6 million spent.

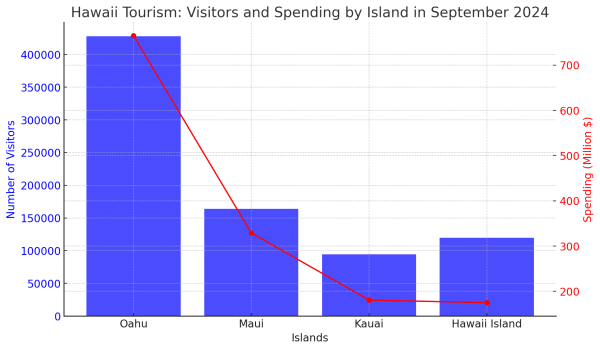

September 2024 Visitation & Spending

September 2024 Summary Update

In September 2024, Hawaii saw 707,486 visitors, a 7.8% increase from September 2023, and $1.45 billion in spending, up 4.6% from the prior year. Visitor arrivals primarily came from the U.S. West and East, with modest increases from Japan and Canada.

Island-Specific Numbers:

- Oahu: 427,841 visitors, $765.1 million spent.

- Maui: 164,092 visitors, $329.2 million spent.

- Kauai: 94,605 visitors, $180.7 million spent.

- Hawaii Island: 119,522 visitors, $174.9 million spent.

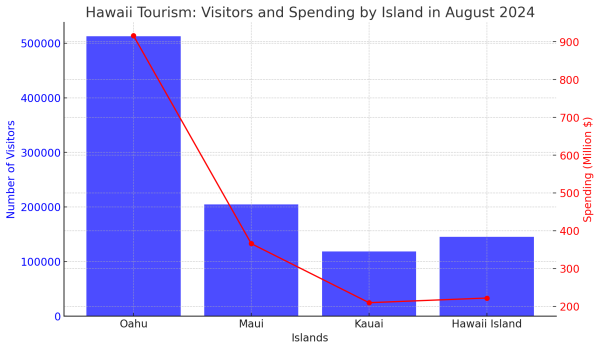

August 2024 Visitation & Spending

August 2024 Summary Update

In August 2024, Hawaii saw a 6.4% increase in visitor arrivals (819,152 visitors) and an 11.4% increase in spending ($1.72 billion) compared to August 2023. Visitor numbers primarily came from the U.S. West and East, with significant changes from Japan and Canada.

Island-Specific Numbers:

• Oahu: 512,661 visitors, $916.0 million spent.

• Maui: 204,596 visitors, $366.0 million spent.

• Kauai: 118,608 visitors, $209.8 million spent.

• Hawaii Island: 145,101 visitors, $222.1 million spent.

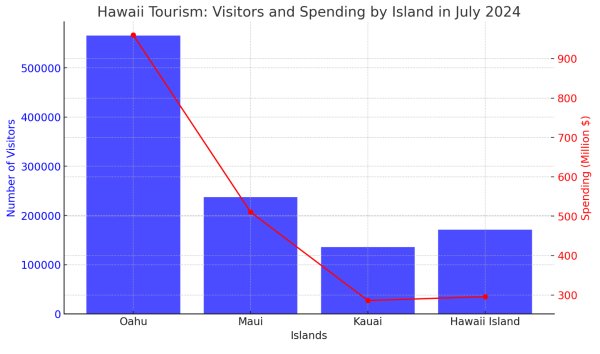

July 2024 Visitation & Spending

July 2024 Summary Update

In July 2024, Hawaii saw a slight decline in visitor arrivals (925,935 visitors, -1.0%) but an increase in spending ($2.07 billion, +2.6%) compared to July 2023. Visitor arrivals primarily came from the U.S. West and East, with significant changes in numbers from Japan and Canada.

Island-Specific Numbers:

• Oahu: 565,629 visitors, $960.0 million spent.

• Maui: 237,495 visitors, $510.6 million spent.

• Kauai: 135,846 visitors, $285.9 million spent.

• Hawaii Island: 171,304 visitors, $295.6 million spent.

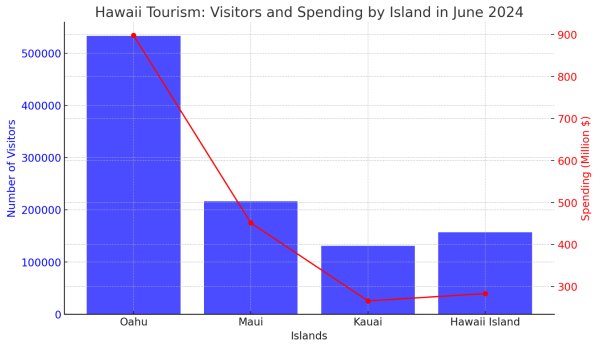

June 2024 Visitation & Spending

June 2024 Summary Update

In June 2024, Hawaii experienced a slight decline in both visitor arrivals (872,620 visitors, -1.9%) and spending ($1.91 billion, -4.4%) compared to June 2023. The majority of visitors came from the U.S. West and East, with notable shifts in Japanese and Canadian visitor numbers.

Island-Specific Numbers:

• Oahu: 532,915 visitors, $897.9 million spent.

• Maui: 216,065 visitors, $451.7 million spent.

• Kauai: 130,923 visitors, $265.9 million spent.

• Hawaii Island: 156,999 visitors, $283.3 million spent.

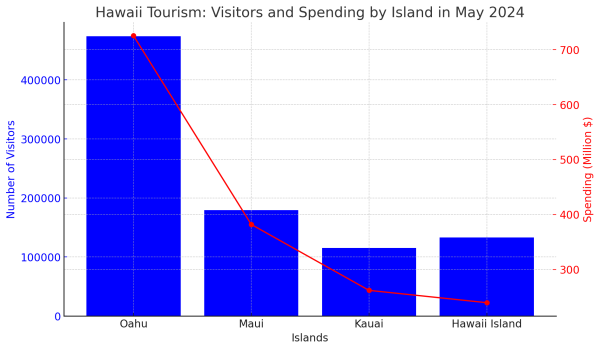

May 2024 Visitation & Spending

May 2024 Summary Update

In May 2024, Hawaii saw a decline in both visitor arrivals (763,260 visitors, -4.8%) and spending ($1.62 billion, -4.0%) compared to May 2023. Visitor arrivals were primarily from the U.S. West and East, with notable changes from Japan and Canada.

Island-Specific Numbers:

• Oahu: 473,837 visitors, $725.4 million spent.

• Maui: 179,233 visitors, $382.0 million spent.

• Kauai: 115,135 visitors, $262.1 million spent.

• Hawaii Island: 133,352 visitors, $239.7 million spent.

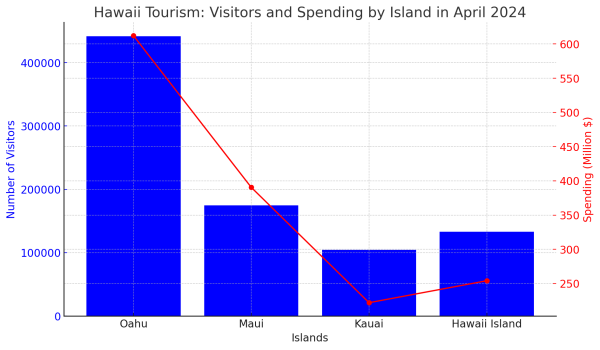

April 2024 Visitation & Spending

April 2024 Summary Update

In April 2024, Hawaii experienced a decline in visitor arrivals (753,551 visitors, -8.9%) and spending ($1.51 billion, -12.6%) compared to April 2023. Visitor arrivals were primarily from the U.S. West and East, with notable changes from Japan and Canada.

Island-Specific Numbers:

• Oahu: 441,685 visitors, $612.2 million spent.

• Maui: 174,582 visitors, $390.5 million spent.

• Kauai: 104,654 visitors, $222.0 million spent.

• Hawaii Island: 133,200 visitors, $254.1 million spent.

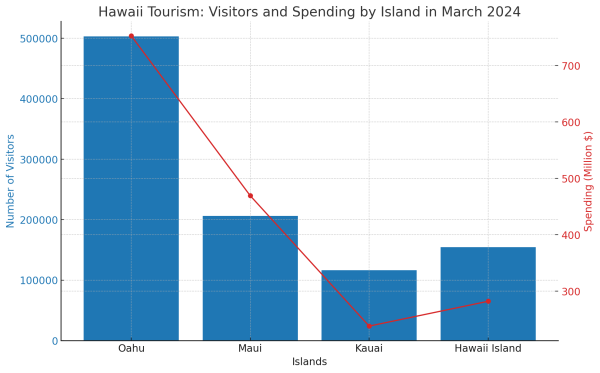

March 2024 Visitation & Spending

March 2024 Summary Update

In March 2024, Hawaii saw a decline in both visitor arrivals (855,537 visitors, -5.0%) and spending ($1.76 billion, -4.2%) compared to March 2023. Visitor arrivals were primarily from the U.S. West and East, with significant changes from Japan and Canada.

Island-Specific Numbers:

- Oahu: 502,933 visitors, $753.0 million spent.

- Maui: 206,049 visitors, $469.4 million spent.

- Kauai: 116,437 visitors, $238.1 million spent.

- Hawaii Island: 154,400 visitors, $282.1 million spent.

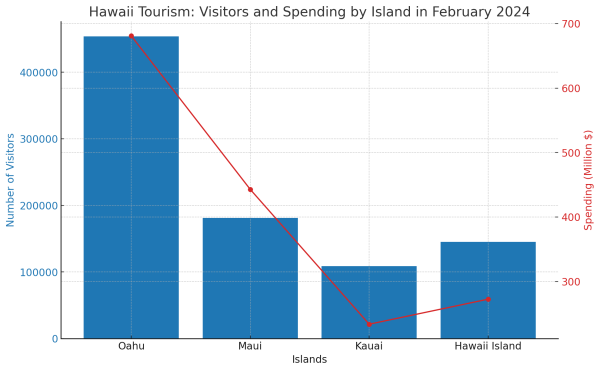

February 2024 Visitation & Spending

February 2024 Summary Update

In February 2024, Hawaii saw 772,480 visitors (+2.5% from February 2023) and $1.66 billion in spending (+1.2% from February 2023). The average daily visitor count was 236,008 (-3.2% from 2023) with a daily spending of $57.1 million (-2.4% from 2023).

Island-Specific Numbers:

- Oahu: 453,719 visitors, $681.1 million spent.

- Maui: 181,301 visitors, $443.1 million spent.

- Kauai: 108,825 visitors, $234.0 million spent.

- Hawaii Island: 145,188 visitors, $272.8 million spent.

Individual Hawaiian Island Data

These statistics are "arrival" data - meaning visitors who arrived in the islands (either from the mainland US, abroad, or from another island).

When viewing these statistics, we encourage visitors to keep the geographic size of the islands in mind. For example, the Big Island and Kauai have very similar trends in arrivals. However, the Big Island is significantly larger geographically speaking than Kauai (in fact, it is larger than all of the other islands combined) so these visitor numbers alone cannot tell the complete story. Kauai and the Big Island may very well have the exact same number of visitors any given month, but the size of the island will also determine how "crowded" it feels.

Big Island of Hawaii Visitor Data

The largest in the chain typically averages between 130,000-175,000 arrivals each month. Excluding the summer "hump" felt through all the islands, the number of arrivals fluctuates much less than some other islands in the chain, so visitation is usually about the same in Hawai'i. The events we noted on the best time to travel to Hawaii page, that are held each spring and fall, can increase visitor ratios on the island. The volcanic eruptions that periodically occur are also likely to impact travel numbers to the Big Island at any given time.

Maui Visitor Data

The second largest island in the chain typically ranges between 150,000-225,000 arrivals each month. The summer "hump" is by far the largest period of arrivals, but there are also significant spikes at other times during the year, most notably around the Christmas holidays. The reopening of West Maui, excluding historic Lahaina Town following the devastating wildfires in August 2023, has positively influenced arrival numbers. Generally, however, we believe Maui visitor numbers will be recovering from large declines following the fires for an extended time.

Kauai Visitor Data

The fourth largest island in the chain typically ranges between 100,000-130,000 visitors each month. Kauai, in general, is a much quieter island (arrival wise) when compared to the likes of the other islands in the chain. But that may be due to its size and "theme" (all things green). The summer "hump" is the only really busy time on the island, though it's not as distinct as the "hump" Maui and Oahu experience. As a side note, the occasional winter and spring storms and subsequent Kauai closures will likely impact visitor arrivals after this period.

Oahu Visitor Data

The third largest island in the chain typically ranges between 450,000-560,000 visitors each month. As you can quickly see, that number significantly dwarfs the other islands' arrival data. Oahu is widely popular with visitors abroad, and given that approximately 75% of the state's population lives on this single island, the arrival data can skew accordingly. The island's diverse attractions, from the bustling city of Honolulu to the historic sites of Pearl Harbor and the scenic North Shore, continue to draw the most visitors among the Hawaiian Islands.

Typical Hawaii Visitor Timeline

Typical Visitor Planning Timeline

More Information:

Hawaii Weather page or Selecting a Hawaiian island to visit

If you want even more detailed tourism specifications, please visit the Hawaii Department of Business, Economic Development & Tourism.

Molokai & Lanai Visitor Data

These two islands only make up slightly more than 1% of all visitor arrivals combined. If you're heading to either of these two islands and are curious about this data, we suggest you look at the detailed statistics provided on the Hawaii Tourism Authority website.

Updated on: 03-01-2025

Published by: John C. Derrick

Founder & certified Hawaii travel expert with 20+ years of experience in Hawaii tourism.

You may also be interested in...

2025 Hawaii

Visitor Guides!

Visiting Hawaii soon?

View Yours Free

~ Detailed maps, insider tips, hotel recommendations, tour & activity suggestions, local dining, and more! ~

Affiliate Disclosure: We may earn commissions from some travel partners (like Amazon or Expedia) which helps us maintain this site. These links are at no extra cost to you and don't impact our honest & unbiased recommendations. Remove all the ads →

Article Published/Updated: 03-01-2025